Six months on: how the FOBT stake cut has changed the bookmaking landscape

April 1 2019 will go down as the day life changed forever for high street bookmakers across Britain.

It was the day the swingeing cut in maximum stakes on the hugely controversial gaming machines called FOBTs (Fixed Odds Betting Terminals) was implemented.

Following years of pressure from campaigners, politicians and the media – who blamed the machines for fuelling problem gambling and causing crime – the government finally agreed to reduce the stakes on the machines to £2 from £100.

It was a move bookmakers said would lead to hundreds of betting shops being closed and thousands of jobs being lost.

The racing industry, although it said it understood the government’s decision, also feared it would lose out on millions of pounds of income from lost media rights payments caused by the shop closures.

Six months on from the new regime’s introduction, betting shops are indeed closing in their hundreds. But there are also some positive signs.

Betting shop numbers falling

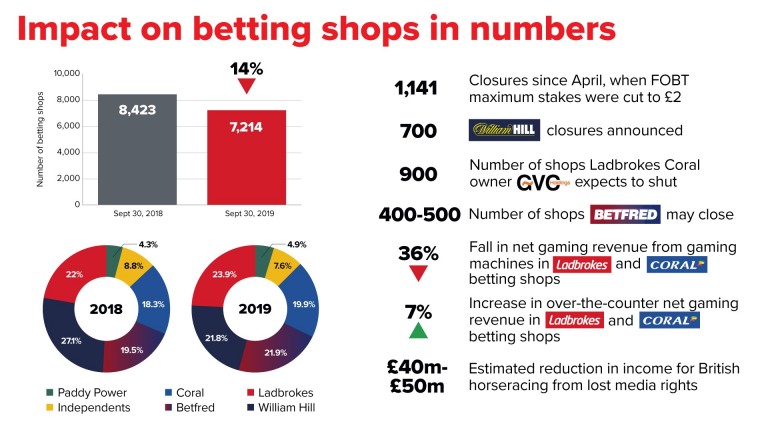

At the end of September 2018 there were 8,423 betting shops in Britain, according to the latest set of Gambling Commission statistics.

In the following 12 months that figure has reduced to 7,214 shops, betting industry sources say. This is a fall of 1,209 shops or 14 per cent. The vast majority of those closures – 1,141 – have come since the start of April.

A spokesperson for the Association of British Bookmakers said: “The stake reduction on gaming machines has resulted in the closure of many of the country’s betting shops.

“Small, family-run businesses that have been at the heart of their communities have been particularly hard hit.

“Like other retailers, bookmakers are also suffering the wider pressures on town centres, such as declining footfall, high business rates and tax. We join with other businesses in calling for help to save our high streets.”

However, the reduction in betting shop numbers has not been spread uniformly across the industry.

Hills take ‘decisive action’

Before the stake reduction was introduced the giants of high street bookmaking – Betfred, Coral, Ladbrokes and William Hill – estimated the £2 stake would mean up to 2,400 of their shops would close.

GVC Holdings, owners of Ladbrokes and Coral, have subsequently trimmed their forecast to 900 shops from 1,000, while William Hill reduced their estimate to 700 shops from 900.

Those two companies have, however, approached their closure programmes in very different ways.

In a trading update last week GVC said 41 of their shops had shut during the three months to the end of September, taking the total closed as a result of the £2 stake to 198.

In contrast, William Hill announced their 700 shop closures would take place before the end of the year and it subsequently emerged the vast majority would shut by the end of September.

It is understood that Hills closed 653 betting shops last month alone.

With a trading update due in a few weeks, William Hill did not wish to add to what the firm reported in their interim results in August.

At the time the company said: “We are confident that the decisive action taken on the shop estate is the right thing to do for the long-term success and sustainability of the retail division. It will result in a profitable estate that is well positioned to gain market share in the future.”

‘Death by a thousand cuts’

Differing approaches to the challenge of the new betting shop environment have also emerged in the independent sector.

In July, Scottish betting shop chain Scotbet announced they were going into receivership, with 11 betting shops closing, although they have so far managed to save a further 30.

In the same month Megabet, the rebranded Stan James chain, entered into a Company Voluntary Arrangement (CVA), a controversial procedure through which retailers can close shops. That allowed them to shut 45 of their betting shops.

However, Greg Knight, the managing director of Britain’s biggest independent betting shop chain, Jenningsbet, is not so downbeat.

“We have closed a smaller than expected number of shops and are looking to consolidate where we are strong,” he said.

Assessing the wider landscape, Knight added: “Hills have taken a very bold step and although others have not adopted the same method of drawing a line and shutting shops in one hit it may prove that they have had the right idea. The loss of shops drags you down and surgery is often the best cure rather than death by a thousand cuts.”

Retail trends ahead of expectations

A number of operators have reported their betting shops have performed better than expected against the gloomy forecasts made before the stake change was implemented, which could in turn be positive for racing.

Over-the-counter (OTC) business in betting shops has been better than expected since April 1, including for GVC, whose recent trading update said that retail trends remained “ahead of expectations”.

While GVC’s machine net gaming revenue (NGR) was down 36 per cent in the third quarter of the year due to the stake cut, over-the-counter NGR was seven per cent ahead, driven in part by money that used to be spent on the machines.

GVC’s managing director for retail, Mark Chambers, said: “Generally customers have responded as expected, although it’s fair to say the uplift in over-the counter business, particularly racing, has been better than we thought as referenced in our trading update on Wednesday [October 9].”

Although it was not enough to prevent the decision to cull 700 shops, William Hill also reported better-than-expected business in their interim results announcement in August, with “both gaming substitution and increased sportsbook staking slightly ahead of our modelling”.

Gaming revenues fell 45 per cent in the second quarter at William Hill, although substitution into other products contributed to a net reduction in retail net revenues of 12 per cent in the first half of the year.

Some of the money that used to be spent on FOBTs has left betting shops altogether, with Rank Group reporting the performance of electronic roulette in their Grosvenor Casinos “was particularly strong”, following the introduction of the £2 stake.

Ivor Jones, an analyst with Peel Hunt, thinks the modelling bookmakers produced to gauge the impact of the new stake has been “pretty accurate”.

He added: “There clearly is a bit of substitution back to over-the-counter betting and it was always impossible to know how much the deterioration in over-the-counter betting was a function of cannibalisation the other way.

“If you hadn’t put the machines in you don’t know what would have happened, but now you know a bit more revenue than people were expecting seems to be coming back over the counter.”

Some established shops ‘thriving’

Betfred, like GVC, have not cut betting shop numbers as quickly as William Hill. Having had an estate of 1,644 shops at the end of September 2018, that number had reduced to 1,579 12 months later.

Owner Fred Done predicted earlier this year they may have to close 400 to 500 shops as a result of the new regime.

Betfred’s chief operating officer Mark Stebbings said their experience mirrored that of their high street rivals.

“We have seen a positive upturn in over-the-counter turnover and we’ll continue the fight to keep our high street shops open,” he said.

At Jenningsbet, Knight revealed shops which had enjoyed well-established over-the-counter business were doing much better than those which had opened up more recently with the aim of chasing FOBT players.

He said: “What we are seeing is that there is now a clear distinction between the shops that were opened in the last six or seven years that were targeting other competitors where the FOBT revenues were very strong and those long-established traditional shops.

“Many of those shops in large towns and cities which were catering for a non-betting demographic are now struggling badly and some operators have more of those shops than others.

“They had no core over-the-counter trade to begin with and were in areas where there was no traditional base. Conversely we have seen shops that have a core base increasing their over-the-counter and self-service betting terminal [SSBT] profits. Slippage is up by 20 per cent in some of those shops and they are thriving.”

Knight said they had embarked on a “major refit programme” for their betting shops.

He added: “We have taken the step of investing in those shops by adding to our OTC content with virtuals, bingo and other products and ramping up our numbers per shop of SSBTs.”

Better atmosphere in some shops

While evidence of the financial effect on bookmakers from the cut in FOBT stakes is starting to accumulate, it is a lot harder to quantify whether the change has had any effect on problem gambling.

Gamcare, the charity which runs the National Gambling Helpline, said it had no statistics available which might show if there had been a change in the number of calls relating to FOBTs since April 1.

The organisation’s annual report which might reveal the effect of the government’s action is not due to be published until 2021.

Similarly, the Gambling Commission said it had no figures that might link problem gambling rates to the stake cut.

The next Health Survey which would cover the relevant period is not due to be published for a number of years and even then there would be no definitive proof of causation.

Anecdotally, however, one betting office manager said the atmosphere in shops had definitely improved.

Speaking on condition of anonymity, the manager said: “We are mainly an over-the-counter shop so we weren’t big on the focus of the machines. We were a traditional betting shop if you like.

“Opposed to the aggression we used to see, this [the £2 stake] has appeared to be more calming. However, you do get the occasion when regardless of the value of the spin people still seem to lose more than they can afford which can then become a problem for them.

“There aren’t as many big losses as there had been previously so it has had a positive effect for the majority of people that want to come in and have fun playing.”

GVC provided further evidence the atmosphere had improved in betting shops for both staff and customers.

Chambers, who thanked the staff in GVC’s betting shops for the way they had coped with the changes, added: “We’ve also seen a significant drop in machine-related security incidents which can only be good news for the shop teams and our customers.”

Racecourse warnings

For British racing, the initial slower-than-predicted rate of betting shop closures has meant the effect on income has not hit home yet.

However, there are plenty of predictions that 2020 will be considerably tougher, especially following William Hill’s closure programme.

Last December Arena Racing Company pre-empted the shop closures by warning it would have to reduce prize-money in 2019, a move which provoked a furious reaction from owners and trainers and eventually resulted in a compromise between parties.

However, accounts for Arc’s divisions which were lodged with Companies House last week warned the £2 stake was “starting to take an effect and is expected to become more significant with William Hill announcing the closure of 700 shops”.

Such warnings from racecourses have increased in recent weeks.

Last month Newbury said it would be “carefully reviewing” its investment in prize-money due to the “significant risk” of falling income caused by betting shop closures, while Musselburgh’s latest finance report warned “racecourses will feel significant downturn in media rights income from 2020”.

In the last few days York’s chief executive William Derby said the media rights situation would be “hard for all racecourses”, while Phil Siers at Chelmsford warned “people in racing have to expect prize-money is going to fall”.

Industry analysts Regulus Partners estimates 2,500 shop closures would cost Arc and its partners £16 million in media rights, while the latest industry estimate puts the overall annual loss of income for the sport at £40 to £50 million.

More closures to come

As for the future of betting shops, Ivor Jones believes there is scope for improving the experience for customers.

“I think the user experience in bookmaking, particularly for new customers, has always been limited in betting shops,” he said. “If some nice person was on this side of the counter and talking to me how would that work?

“Maybe there is a lot more to be done in terms of customising the shop experience now that there is an obligation to get more data about customers at lower levels.

“There is the question of along with the betting what else can you offer in the shop. Probably not coffee and probably not food in any meaningful way.

“There is video content, but in a small space, how do you have the big match on the wall in a really immersive way without the sound and video blocking out the dog racing?”

Chambers believes there remains a “great future” for GVC’s remaining betting shops.

“The ultimate number of Ladbrokes Coral shop closures will depend on a number of factors including competitor closures,” he said. “Clearly as shops close those remaining open become busier. It creates a much better atmosphere to stay and have a bet.

“We’ll continue to look at profitability on a shop-by-shop basis but beyond the stakes reduction our shops have a great future.

“We’re investing in new technology including the further rollout of self-service betting terminals. Many of our customers also bet online with Ladbrokes or Coral which provides a unique opportunity to service customers through our shop network.”

However, there are still many more betting shop closures to come.

Knight said: “I think two years from now we will see final numbers of betting shops down to roughly 6,500, the lowest since they were first licensed.

“Unfortunately, for many of those who campaigned for a £2 stake that will be considered a good thing.”